Today, I’m delighted to share a post from Lyn Mettler. Lyn has actually gained over $ 6, 000 in just 15 months by utilizing an obscure technique called financial institution incentives. In this write-up, she breaks down precisely how it works, why banks want to pay you, and exactly how you can begin, too. Quick summary straight from …

Today, I’m delighted to share a write-up from Lyn Mettler. Lyn has made over $ 6, 000 in just 15 months by using a little-known method called financial institution perks. In this write-up, she breaks down exactly just how it works, why financial institutions want to pay you, and how you can get going, too. Quick summary straight from Lyn: “It has to do with the simplest side rush I have actually ever before stumbled upon: opening up examining accounts and making the cost-free reward (usually $ 300 -$ 400 for depositing the required quantity generally in the very first 90 days. Lyn likewise developed the Bank Reward Blueprint training course , where she educates the specific system she uses so you can follow along and earn money. This can be a remarkably simple means to make extra revenue without a great deal of time or effort!

If you’ve been hanging around the individual money world for a while, you’ve probably seen lots of ways to gain additional income : side rushes, cash-back apps, study websites, even reselling on ebay.com.

Yet there’s one strategy that most people completely forget — and it is just one of the easiest, fastest ways to make complimentary cash I’ve ever before found.

I’m speaking about financial institution rewards

Yes, those “open a bank account and get $ 300 deals you’ve possibly scrolled past or threw in the reusing bin without much idea! They may look small initially glimpse, however if you recognize exactly how to string them together, they can add up to countless dollars really quickly.

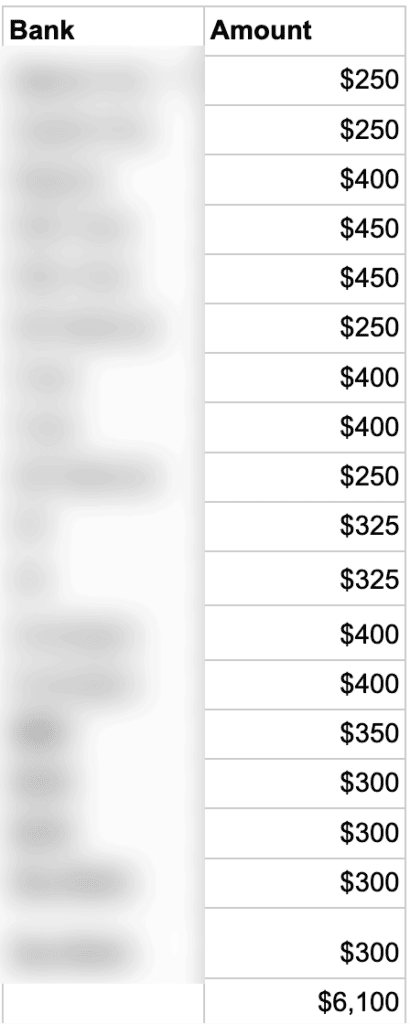

I know, because I’ve done it myself. Since July 2024, I have actually gained greater than $ 6, 000 in cost-free money by finishing 18 financial institution incentives– and I’m not stopping anytime quickly.

Exactly what Is a Bank Incentive?

A bank perk is when a financial institution pays you (normally around $ 200–$ 400, sometimes a lot more) to open a new bank account with them and fulfill a few basic demands.

Typically, that resembles:

- Opening a brand-new checking or interest-bearing account

- Establishing direct deposits of a specific amount within a particular duration (generally 90 days)

- Then transferring it back to your primary account (or paying what you require straight from this account)

Afterwards, the bank pays you the reward.

You do not require to keep the account open for life. You don’t need to jump through endless hoops. Actually, financial institutions anticipate that many people will open the account, obtain the reward, and eventually shut it.

So why do they offer this in the first place?

Suggested analysis: 17 Reduced Effort Side Hustles That Can Make You Money

Why Financial institutions Are Happy to Pay You Numerous Dollars

When I first learned about this, I had the same question: Why would a bank simply hand me cash like this? What’s the catch?

Below’s the within scoop, right from a coworker of mine who’s worked in the financial sector.

Banks like to keep a healthy equilibrium of deposits contrasted to the money they provide out, and supplying bonus offers is an easy way to bring in new cash money promptly while attracting new clients.

So to enhance deposits swiftly and to bring in new customers, financial institutions will certainly incentivize clients like you and me to relocate cash into their accounts. Even if it’s simply for a little bit, that down payment helps their publications by showing they have the correct amount of money handy to cover their loans.

So no– you’re not injuring the bank by opening an account, collecting the bonus, and ultimately closing it. In fact, you’re assisting them. Win-win!

Note from Making Sense of Cents: Obviously, financial institutions are wishing that you’ll remain longer than just a few months, as well. These benefits are their method of obtaining brand-new clients in the door. Once you’ve opened up an account, set up straight deposit, and linked a couple of bills, they understand that it becomes even more of a trouble to leave. That’s what makes you a “stickier” consumer– somebody that’s less likely to switch financial institutions once again. So while they’re paying you that initial reward, they’re additionally wagering that you’ll locate it less complicated to simply stay.

My Tale: From Cynical to $ 6, 000

When I initially found out about bank bonus offers, I’ll admit– I was hesitant. It seemed as well very easy.

However I chose to test it. I opened an account with a national bank that was providing $ 400 for a straight down payment of $ 500 or extra within 90 days. Easy peasy. I switched over one paycheck over to that account. Indeed, a few weeks later on, $ 400 showed up. A number of minutes of my time netted me $ 400 completely cost-free.

I was hooked.

From there, I started piling deals– often running one benefit for me and another for my husband at the exact same time. I would certainly let 2 incomes struck one account, shut it after the bonus posted, and proceed to the next.

In just 15 months, I’ve completed 18 benefits completing more than $ 6, 000

That’s $ 6, 000 for doing nothing greater than relocating cash about– something we’re currently doing on a monthly basis.

Genuine People Are Doing This As well

And it’s not simply me. I have actually shared this method with my viewers and members, and right here’s what some of them have stated:

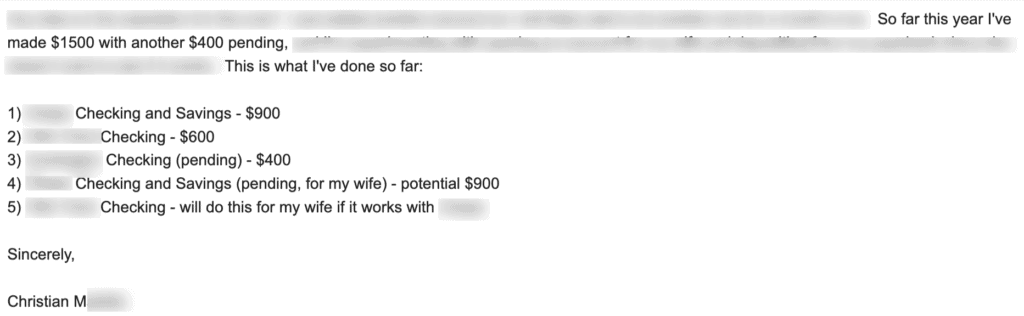

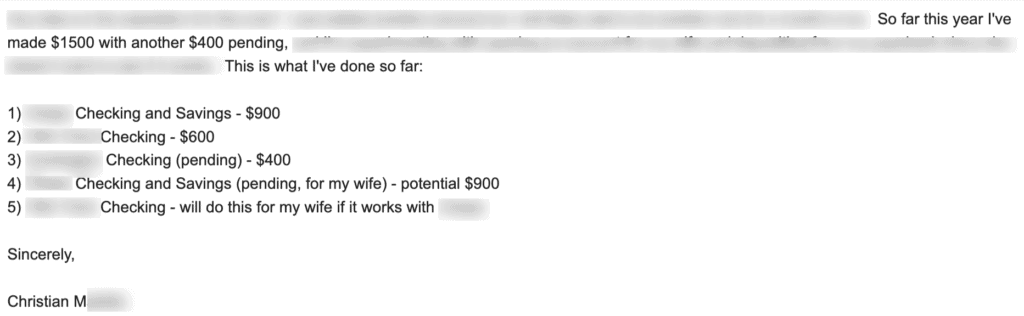

- “Until now in 2025, I have actually made $ 1, 500 with one more $ 400 pending.”– Christian

- He’s opened up 5 accounts up until now using my technique.

- “I was motivated by Lyn’s information on making bank rewards, so I opened an account to see if I could cover some unexpected veterinarian expenses. The other day, I got the $ 300 perk.”– Janet

- “I obtained my very first incentive and we placed that toward our Disney holiday! I’m really hoping that all the perks together will certainly spend for every one of our dining costs at Disney.” — Jim B

- “I’m in the process of gaining 2 $ 400 benefits — so easy!”– Jason

I made use of a recent financial institution reward to buy season tickets to Notre Dame home football games– so enjoyable! (I get a reduced cost as a present graduate student, so for only, $ 300 I can most likely to as several video games as I want).

What could you make use of a bank perk to cover?

- Holiday presents

- Your following resort keep

- Unexpected costs (like vet or clinical costs)

- Braces

- College cost savings and tuition

- Financial debt

- Donation

- Investment

- Car payments

- New tires

- A new appliance

- Your following travel card annual cost

- A fancy supper out

- New garments

- Stylish brand-new tennis shoes

- A gift

It’s not a “get abundant quick” system. It’s not something shady or complicated. It’s merely benefiting from offers banks are currently producing there and opening your hand to free money they’re currently handing out. I desire my reasonable share, do not you?

Why This Works So Well as a Side Hustle

What I love most around this method is exactly how low-effort it is.

- You don’t require unique skills.

- You do not require a lots of time.

- You don’t require to spend money in advance.

If you currently have a paycheck or benefits that can be direct-deposited (and more than an income counts as a straight deposit, which I describe inside my Financial Institution Incentive Blueprint training course), you can do this. And unlike many side hustles, you don’t have to maintain boning up at it. As soon as the incentive articles, you’re done. On to the following one!

Just How Much Can You Truly Earn?

Right here’s a realistic take a look at what’s feasible:

- A single perk is usually worth $ 200–$ 400

- Do 1 per month, and you’re looking at ~ $ 3, 600

- If you and a spouse/partner both participate, you can quickly double that

- You can even show your kids with tasks how to do this and take that income and wait away for a rainy day!

Like I stated, I’ve directly gained over $ 6, 000 in around 15 months. That’s more than many individuals make in a part-time job over the very same duration– without appearing anywhere and investing just a couple of minutes below or there working on this.

Yet What About Tax obligations?

You might be asking yourself: If I gain this money, do I owe tax obligations on it?

Yes, bank bonuses are considered gross income. The bank will send you a tax paper at the end of the year, comparable to if you gained self-employed earnings, interest income on a savings account, or some other sort of revenue.

I’m not an accountant, so I suggest you consult yours for your details scenario. But also after tax obligations, these rewards are well worth it, because you’re still netting a ton of complimentary money.

My Trump card: A Simple System

Here’s things. It’s not nearly enough to simply open an arbitrary account when you see a deal. To maximize your revenues, you need a system.

You require to:

- Know which banks are currently using the very best offers

- Know which banks to avoid because they make it hard (most do not, but I’ve had a few that I would certainly NOT suggest)

- Track demands and due dates so you do not miss out on a reward

- Understand just how to strategically rotate who’s earning the incentive

- Know the easiest means to access your cash once it’s transferred (both direct deposits and the benefit) and close the account when you’re done

- Understand just how to set up the account, like should you establish overdraft account security, add your partner to the account, ask for a debit card or checks, etc.

- Prevent common errors that can invalidate you

That’s specifically why I created my Bank Bonus Offer Blueprint course. It’s the step-by-step system I’ve utilized to gain $ 6, 000 in complimentary cash (and counting).

Right here are some testimonies from people who have actually taken my program:

Frequently Asked Inquiries

Below are answers to usual questions regarding making money with financial institution benefits.

1 Does this pain my credit history?

No. Unlike credit cards, opening up an examining account typically causes a “soft pull” (or nothing in any way) on your credit score report, not a tough questions. So there is generally no influence to your credit report. If you’re worried, it’s a good concept to examine the deal information first simply to see to it.

2 Do I need to keep the account open forever?

Not at all. As soon as you’ve met the requirements and the bonus has published, you can close the account if you want. You loaned them the cash they needed, now take yours and run:-RRB-. Simply make sure to inspect whether the financial institution needs you to keep the account open for a couple of months prior to shutting it, as some will take the incentive back if you close ahead of time.

3 What if I do not get an income straight transferred?

Numerous banks accept points like Social Safety and security benefits, retired life distributions, or perhaps tax obligation refunds. It does not constantly need to be a paycheck– though you ought to constantly check the fine print.

4 The number of benefits can I do simultaneously?

It depends on just how much adaptability you have with your straight deposits. I usually suggest beginning with one at a time until you master it.

5 Is this truly worth the effort?

Allow me put it by doing this: would certainly you change where your paycheck lands for a month if someone handed you $ 300 I’ll do that every single time!

Exactly how I Made $ 6, 000 in 15 Months From Bank Rewards– Summary

If you’ve been searching for a side rush that doesn’t consume your time, a means to boost your cost savings without reducing, or simply a fun challenge that pays you real cash– you’ll wish to provide financial institution benefits a shot.

I have actually seen direct how this can add thousands to your savings account in a year. And when you know the system, it ends up being automated.

The reality is, lots of people skim right past these deals without realizing exactly how effective they are. Yet the ones that act? They’re laughing completely to the financial institution– literally.

If you want to discover exactly just how I do it (detailed), look into my Financial Institution Bonus Plan It’s the specific procedure I utilized to gain $ 6, 000 in 15 months, damaged down so you can begin making your own cost-free cash immediately. How much can YOU make?

Please visit this site to read more regarding Bank Bonus Plan.

Have you ever before attempted making money from financial institution bonuses? If so, just how much have you made– or would certainly you ever provide it a try?

Author biography: Lyn Mettler is a long-time traveling writer, business owner, and couponer that loves a bargain. She mastered the art of constantly flying her entire family members of 4 complimentary in 2015 and now runs the Families Fly Free subscription, where she instructs families around the U.S. her simple system to fly and take a trip completely free utilizing miles and factors. She has visitor published on Making Sense of Cents in the past too, and you can read it at How My Household of 4 Flies Free 6 Times Each Year

Advised analysis: